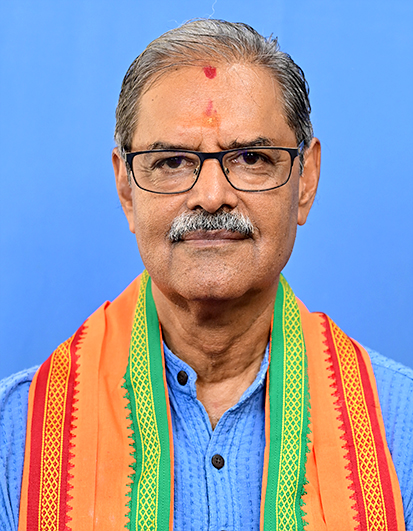

RBI Appoints Sanjay Kumar Hansda as Executive Director

Veteran central banker to head Department of Economic and Policy Research from March 2025

Bhubaneswar : The Reserve Bank of India (RBI) has appointed Sanjay Kumar Hansda as Executive Director (ED) effective March 3, 2025. The announcement marks a key addition to the central bank’s top management team. Hansda, a seasoned economist and career central banker, recently returned to India after completing his tenure as Senior Advisor to the Executive Director (India) at the International Monetary Fund (IMF).

According to an official statement from the RBI, “Hansda reported back to the Bank on October 6, 2025, after completing his deputation at the IMF. He will take charge as Executive Director with effect from March 3, 2025, and will oversee the Department of Economic and Policy Research (DEPR).”

With more than 30 years of experience in central banking, economic analysis, and policy formulation, Hansda is known for his deep understanding of India’s macroeconomic and financial systems. Before this appointment, he served as Adviser in the same department — DEPR — where he was involved in shaping the bank’s research and policy framework.

Over his long career, Hansda has held several significant positions within the RBI. He has served as Adviser in the Monetary Policy Department, where he contributed to policy formulation on inflation management, liquidity operations, and interest rate strategy. He also worked as Officer-in-Charge and Director in the Internal Debt Management Department, overseeing government securities, market borrowings, and debt management operations.

Earlier in his career, Hansda was seconded to the Bank of England as an Analyst, focusing on financial stability and global market dynamics. This international exposure strengthened his expertise in global macroeconomic coordination, making him a valuable contributor to discussions on cross-border financial policies.

In his new role, Hansda will lead the Department of Economic and Policy Research — the think tank of the Reserve Bank — which provides analytical support for monetary, fiscal, and structural policy decisions. The department plays a vital role in macroeconomic modeling, research publications, and policy recommendations.

Hansda’s expertise spans key areas such as banking sector reforms, financial markets, capital flows, monetary policy, inflation targeting, growth management, and debt sustainability. He has been actively involved in inter-regulatory coordination and contributed to several G-20 and international policy discussions on behalf of India.

A career marked by analytical rigor and policy insight, Hansda has also been part of committees formed by the RBI, the Ministry of Finance, and international financial institutions, including the Committee on the Global Financial System (CGFS). His work has consistently focused on aligning India’s financial system with evolving global standards while safeguarding domestic stability.

Sanjay Kumar Hansda’s academic background complements his professional accomplishments. He holds a postgraduate degree in Economics from Jawaharlal Nehru University (JNU), one of India’s leading institutions for economic studies, and a diploma in Financial Services Management from Jamnalal Bajaj Institute of Management Studies, University of Mumbai.

His combination of academic depth, practical policy experience, and international exposure positions him well to guide the RBI’s research and policy strategy in the coming years.

With Hansda’s appointment, the central bank aims to strengthen its analytical and policy research framework at a time when India’s economy is navigating a complex global environment marked by fluctuating commodity prices, inflationary pressures, and rapid digital transformation.

The RBI’s decision reflects its commitment to fostering a data-driven, research-backed approach to policymaking, ensuring monetary and financial stability while supporting India’s sustained economic growth trajectory.