Odisha Strengthens Green Energy Drive with RE Banking Pacts for 56.25 MW

Agreements with ReNew E-Fuels and UltraTech Cement mark a new milestone in state’s renewable transition

Bhubaneswar : In a major boost to Odisha’s renewable energy transition, the Grid Corporation of Odisha (GRIDCO) has formalised renewable energy (RE) banking agreements with two leading industrial entities—ReNew E-Fuels Private Limited for 50 MW and UltraTech Cement Ltd for 6.25 MW. The pacts, signed in Bhubaneswar, are expected to strengthen the state’s clean energy ecosystem while driving industrial decarbonisation and sustainability.

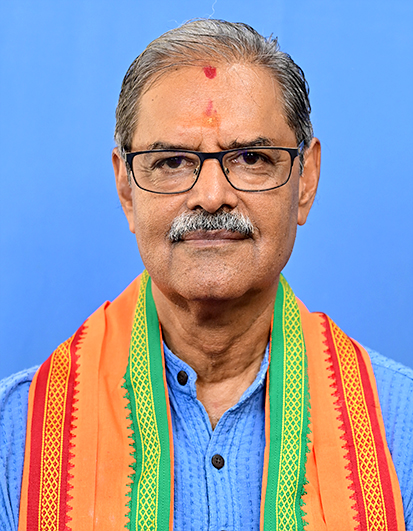

The signing ceremony, held in the presence of Deputy Chief Minister and Energy Minister Kanak Vardhan Singh Deo, marks a crucial step toward integrating renewable power into Odisha’s industrial growth strategy. These agreements will play a pivotal role in supporting emerging sectors like Green Hydrogen and Green Ammonia production—technologies central to India’s long-term clean energy goals.

Deputy CM Singh Deo highlighted the significance of this milestone, describing it as a demonstration of Odisha’s strong commitment to sustainable industrialisation. “This agreement reinforces Odisha’s leadership and commitment focused towards industrial development, backed by robust green infrastructure, strategic seaports, and proactive policies. We are building a future-ready energy ecosystem capable of meeting rising industrial demand through clean power,” he stated.

The minister also revealed that Odisha has already approved 14 Green Hydrogen and Green Ammonia projects, representing a cumulative proposed investment of nearly ₹2 lakh crore. These projects are projected to generate around 22,000 direct and indirect employment opportunities, reinforcing the state’s growing prominence as a green manufacturing hub.

Explaining the concept of renewable energy banking, Principal Secretary (Energy) Vishal Dev said the mechanism addresses one of the most critical challenges in the renewable energy sector—intermittency. “Since generation from renewable sources like solar and wind is weather-dependent, banking of RE power allows consumers to store surplus energy produced during periods of high generation and draw it later during low generation times,” Dev elaborated. This not only stabilises power supply but also maximises the use of green electricity for industries.

In essence, renewable energy banking acts as a virtual storage system that balances demand and supply, ensuring consistent energy availability without relying on fossil fuel-based backup systems. For industries such as cement, steel, and green hydrogen, which require steady power, this model provides an efficient, sustainable solution to manage energy fluctuations.

Odisha’s policy landscape has been instrumental in facilitating these developments. The Odisha Renewable Energy Policy 2022 and the Odisha Electricity Regulatory Commission (OERC) (Promotion of Renewable Energy through Green Energy Open Access) Regulations, 2023, have laid a strong foundation for renewable adoption through open access routes. These frameworks incentivise both the generation and consumption of renewable power, particularly for energy-intensive industries transitioning to low-carbon operations.

Furthermore, the policies encourage investment in next-generation green fuels such as hydrogen and ammonia by offering fiscal benefits, simplified clearances, and infrastructure support. Such forward-looking measures have made Odisha an attractive destination for clean energy investors and industrial innovators alike.

The event witnessed the presence of GRIDCO Managing Director Satyapriya Rath, along with representatives from ReNew E-Fuels and UltraTech Cement, and senior officials from the Energy Department. Their participation underscored the importance of private-public collaboration in achieving the state’s renewable goals.

By enabling industries to integrate renewables seamlessly into their operations, the RE banking initiative represents a model for other states seeking to combine industrial growth with environmental stewardship. It not only supports the decarbonisation of heavy industries but also aligns with India’s national objectives under the Panchamrit commitments and the Net Zero 2070 vision.

As global markets shift toward greener production systems, Odisha’s proactive measures—such as the RE banking agreements—are positioning it as a leader in clean industrial transformation. The initiative is not merely a policy milestone; it is a blueprint for a sustainable, resilient, and inclusive energy future that balances growth with ecological responsibility.