Odisha Banks Achieve ₹1.20 Lakh Crore Credit Disbursement

SLBC reviews ACP progress, urges stronger MSME lending and financial inclusion

Bhubaneswar: Banks operating in Odisha have disbursed ₹1.20 lakh crore—47.65% of the targeted ₹2.52 lakh crore—under the Annual Credit Plan (ACP) for the financial year 2025–26. The progress was reviewed during the 181st State Level Bankers’ Committee (SLBC) meeting held at Hotel Mayfair in Bhubaneswar.

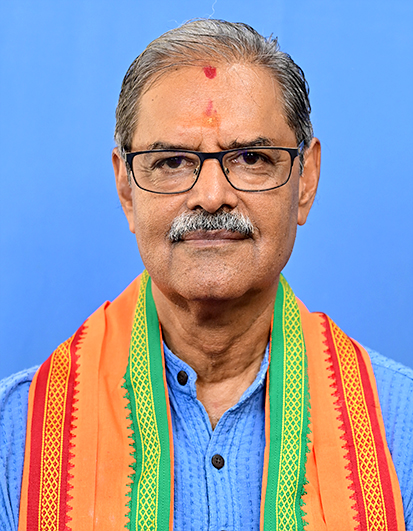

The meeting was chaired by Rajendra Kumar Saboo, Executive Director of UCO Bank and Chairman of SLBC Odisha. Senior officials from the State and Central governments, NABARD, and representatives from various banks participated in the discussion, focusing on strategies to boost credit flow, strengthen MSME financing, and expand financial inclusion across the State.

During the meeting, Principal Secretary of the Finance Department, Sanjeeb Kumar Mishra, outlined Odisha’s development roadmap under ‘Vision 2036 and Vision 2047’. He urged banks to speed up ACP achievement and improve the State’s Credit–Deposit (CD) ratio. Mishra also emphasised the importance of adopting Central KYC (CKYC) across all banks and raising public awareness about schemes like Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY), especially regarding the claims process for beneficiaries.

RBI Regional Director, Dr. Sarada Prasan Mohanty, underscored the role of ACP targets in driving economic development. He called for stronger cybersecurity mechanisms, prevention of digital fraud, and early resolution of issues related to unclaimed deposits and KYC compliance.

A major part of the discussion centred on MSME financing. Commissioner-cum-Secretary of the MSME Department, Prasanth Kumar Reddy, urged banks to strictly adhere to the revised norms for MSME lending and ensure timely support under schemes such as PMEGP, PMFME, PMMY, Stand-Up India and the PM-Vishwakarma Scheme. Director of Industries, Aboli Sunil Naravane, highlighted the importance of PMEGP and PMFME in promoting entrepreneurship and creating local employment.

Performance under the PMSVANidhi scheme was also reviewed, with SLBC deciding that individual bank branches must work towards meeting their respective targets to ensure broader coverage.

The meeting concluded with a collective call for banks to enhance their credit outreach and support Odisha’s long-term growth plans through improved financial inclusion and streamlined banking services.