CM Majhi Welcomes New GST Reforms as Boost for Odisha’s Farmers, Traders and Tribal Communities

Relief in insurance, agriculture, and kendu leaf taxation hailed as historic step towards Modi’s vision of Vikshit Bharat by 2047

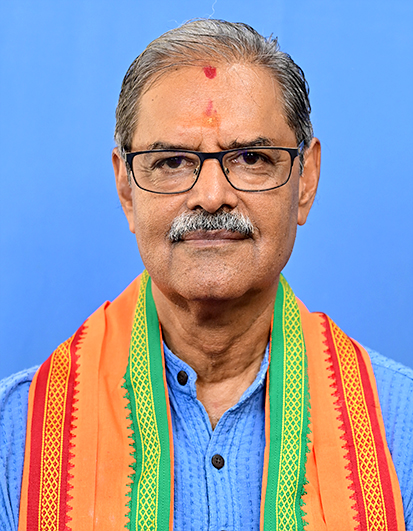

Bhubaneswar : Odisha Chief Minister Mohan Charan Majhi has welcomed the landmark two-tier Goods and Services Tax (GST) framework approved by the GST Council, describing it as a decisive step towards realizing Prime Minister Narendra Modi’s vision of Vikshit Bharat by 2047. The Chief Minister, who attended the 56th GST Council meeting in New Delhi chaired by Union Finance Minister Nirmala Sitharaman, said the reforms would have direct and far-reaching impacts on Odisha’s economy, especially its farmers, small traders, middle-class households, and tribal communities.

“The Council approved relief in GST on life and health insurance, agri-inputs, farm machinery, and life-saving medicines, along with rationalisation to support tribal livelihoods. These reforms will directly benefit farmers, MSMEs, small traders and middle-class families,” Majhi said. He emphasized that the rationalisation proposals would ease compliance, reduce business costs, and create a simpler and more efficient tax framework nationwide.

Highlighting the significance of the GST cut on kendu leaf—a forest produce that sustains the livelihoods of thousands of tribal families in Odisha—the Chief Minister said the reduction of tax from 18 per cent to 5 per cent was a “historic and socially just decision.”

“This move will immensely benefit primary procurers belonging to marginal sections of society with better prices and sales. It will encourage government procurement agencies to buy larger volumes, and also help leaf collection workers in deregulated areas to get higher prices from private vendors,” Majhi explained.

Kendu leaf is widely used in Odisha’s beedi industry, employing thousands of women and tribals in collection, processing, and sales. The tax relief, he noted, will translate into tangible income gains for tribal families while strengthening the state’s rural economy.

Support for farmers and rural economy

The CM also hailed the GST reduction on agricultural inputs and farm machinery, noting that the decision would ease the financial burden on farmers, lower production costs, and make essential items more affordable.

“This step will encourage growth in the agriculture sector, strengthen rural income, and contribute to food security for the nation,” Majhi said. He stressed that Odisha’s large agrarian population, particularly small and marginal farmers, would see immediate benefits from reduced input costs.

Insurance becomes more accessible

The Chief Minister welcomed the decision to exempt life and health insurance premiums for individuals from GST. He said this would make insurance more accessible for middle- and lower-income families in Odisha, improving financial security and health coverage in a state where awareness and penetration of insurance products have remained low.

“This reform will help more families access health and life protection, reduce out-of-pocket expenses, and create a stronger social safety net,” he said.

Fair sharing of Compensation Cess

Majhi also expressed support for the merger of items under compensation cess in the GST framework and called for an equitable sharing of the surplus between the Centre and the states.

“Surplus in the Compensation Cess account may be shared between the Centre and States in the ratio of 50:50. Among states, it may be distributed based on each state’s share of GST revenue calculated on the base year formula,” he suggested, while supporting the proposal to abolish the levy of compensation cess by October 31, 2025.

Boost for MSMEs and traders

The Chief Minister further welcomed the move to simplify compliance for small traders, startups, and self-employed individuals by introducing easier online registration and reduced paperwork. Odisha’s growing micro, small and medium enterprises (MSME) sector, he said, would benefit significantly from streamlined processes and reduced compliance costs.

“The reforms will encourage entrepreneurship, foster innovation, and provide opportunities for small traders and startups to expand without being overburdened by complex tax procedures,” Majhi remarked.

Odisha’s role in India’s tax reforms

Majhi underlined that the new GST framework reflects the government’s commitment to creating an inclusive economic environment where every section of society—from tribal leaf collectors to urban entrepreneurs—can benefit from growth.

“These reforms align with Odisha’s vision of inclusive development, rural empowerment, and social justice. With this rationalised structure, both Odisha and India will move closer to achieving Vikshit Boar At by 2047,” he concluded.

The Chief Minister’s remarks have drawn attention to how the reforms are not just national policy changes but also deeply relevant to Odisha’s local economy and communities. By addressing the needs of farmers, tribals, small traders, and households, the GST reforms are expected to set a new direction for inclusive growth in the state.